Home Buyers’ Plan (HBP)

What it is:

Allows you to withdraw up to $35,000 (now $60,000 for couples) from your RRSP tax‑free to use as a down payment. You repay it over 15 years at 1/15 per year.

✅ Pros:

-

No taxes if repayments are on time.

-

Can cover a large chunk of your down payment.

-

Funds can be used flexibly for eligible home purchases.

⚠️ Cons:

-

Must repay, missed annual instalments count as income.

-

Drains retirement savings, which may grow better long-term.

FHSA (First Home Savings Account)

What it is:

A new tax-advantaged account (can contribute up to $8,000/year, max $40,000) that offers RRSP-style deductions and TFSA-style tax-free growth and withdrawals for your first home.

✅ Pros:

-

Deductible contributions, plus any gains aren’t taxed on withdrawal.

-

No repayment obligation.

-

You can combine FHSA and HBP for larger down payment options.

⚠️ Cons:

-

One-time use only; once used, the account closes.

-

Need discipline to fully fund it; unused room doesn’t convert after closing.

First‑Time Home Buyer Incentive (FTHBI) – Now Discontinued

What it was:

An interest-free shared equity loan (5% resale homes, 10% new builds). CMHC withdrew the program, closing it after March 31, 2024.

Why it ended:

-

Low participation due to strict income/property limits.

-

Buyers didn’t like sharing home equity.

-

Admin costs were high relative to impact.

So—Are These Programs Worth It?

HBP:

✅ Great for large down payments, but borrows from your retirement and must be paid back.

FHSA:

✅ Best all-around tool—double tax benefit, no repayments, flexible savings.

⚠️ Only usable once, so timing matters.

FTHBI:

No longer available. If you still have one through old approval, consider long-term repayment plans carefully due to equity sharing.

Quick comparison:

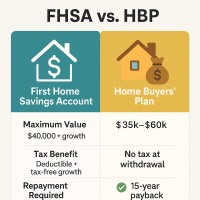

| Program | Max Value | Tax Benefit | Repayment Required? | Best For |

|---|---|---|---|---|

| FHSA | $40,000 + growth | Deductible + tax-free growth | ❌ No repayment | Tax-savvy savers aiming for max return |

| HBP | $35k–$60k | No tax at withdrawal | ✅ Yes – 15-year payback | Those with RRSP savings ready now |

| FTHBI | 5–10% equity | N/A (was interest-free) | ✅ Shared equity repayable | Not available for new buyers |

💡 Final Word

-

FHSA is the most powerful for long-term savers—no taxes, no payback, maximum flexibility.

-

HBP is worth considering if you already have RRSP savings and don’t mind a structured repayment.

-

FTHBI is no longer available for new applicants.

Combine FHSA + HBP? Absolutely—use HBP first, then top up with FHSA.

That combo gives you potentially $100,000+ towards your home, with tax perks and less impact on long-term growth.

✔️ Is it worth it?

If you're preparing for a first‑time purchase:

-

Open and max your FHSA, instant tax break and savings boost.

-

Use HBP if your RRSP holds funds you’re willing to repay.

-

Skip FTHBI, it's no longer available.

Together, these programs can significantly shrink your mortgage size and help make owning your first home more affordable.

Post a comment