Ever feel like buying your first home is more about juggling family favors and dodging financial landmines than picking out paint colors? You’re not alone. In today’s market, many first-time buyers are leaning heavily on family support just to get their foot in the door. But with that help comes a new set of challenges, especially when it comes to managing debt and making smart financial moves.

Let’s break it down.

The Family Boost: When Support Makes the Difference

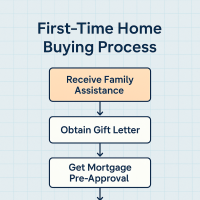

In Canada, it's becoming increasingly common for first-time home buyers to receive financial assistance from family members. Whether it’s help with covering closing costs, co-signing the mortgage, or even pitching in toward the down payment, that extra support can make a world of difference.

Not every buyer has access to this kind of help, but if family support is available, it’s absolutely worth exploring. A conversation with your lender or mortgage broker can help clarify how this type of contribution might work in your specific situation.

The Debt Trap: Why New Credit Can Hurt You

While family assistance can provide a crucial boost, it's equally important to avoid taking on new debts during the home buying process. Opening a new credit card or financing a car can negatively impact your credit score and debt-to-income ratio, potentially jeopardizing your mortgage approval.

Lenders scrutinize your financial stability during the mortgage process. Any significant changes, like new debts or large purchases, can raise red flags and may lead to a denial of your mortgage application.

The Balancing Act: Managing Expectations and Finances

Just because you have some help doesn’t mean you can afford any home on the market. Getting pre-approved for a mortgage is a crucial first step. It gives you a realistic picture of what you can afford, taking into account your income, debts, and credit history.

Pre-approval sets a healthy boundary and keeps you from stretching your finances too thin. Remember, your goal is to find a home that fits your life and your budget, not one that leaves you financially stressed from day one.

Final Thoughts

Buying your first home is a big deal, and in today’s market, it often takes a team effort. If you’re fortunate enough to have family willing to help, it can open doors that might otherwise be out of reach. But regardless of who’s pitching in, managing your finances carefully is non-negotiable.

Avoid new debts, get pre-approved, and be realistic about what you can afford. That way, you’re not just buying a home, you’re setting yourself up for long-term financial success.

Post a comment